In today’s world, having a good CIBIL score is crucial. Many people overlook its importance, which can lead to challenges when trying to secure loans from banks.

A strong CIBIL score makes a significant difference. With a high score, banks actively seek you out for loan offers, and credit card companies are more likely to reach out with attractive deals. Essentially, a good CIBIL score can simplify many aspects of your financial life.

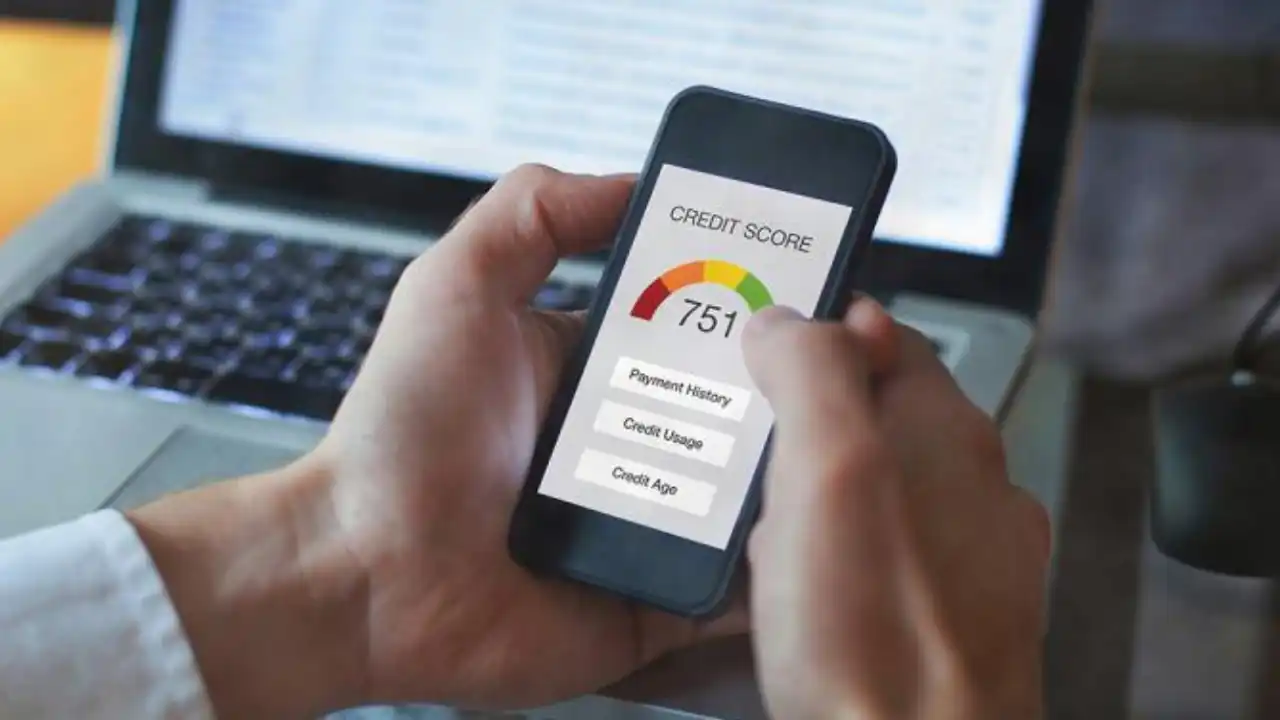

What is a CIBIL Score?

A CIBIL score reflects your creditworthiness and ranges from 300 to 900. Your score depends on your credit history—specifically, how well you manage loans and credit card payments. If you pay your bills on time, your score will be good.

Conversely, missing payments or defaulting on loans negatively impacts your CIBIL score, making it harder to secure loans in the future.

On which score will you get a credit card

Your CIBIL score plays a crucial role in determining your eligibility for a credit card. Here’s how it breaks down:

- 300 to 500: Poor — Difficult to secure a credit card.

- 500 to 650: Average — Limited credit card offers available.

- 650 to 750: Good — Regularly receive credit card offers.

- 750 to 900: Excellent — High chance of getting the best credit card options.

What will happen if the CIBIL score is bad

Having a low CIBIL score can lead to several challenges, including:

Loan Rejection: Banks may reject your loan applications due to your poor score.

Higher Interest Rates: If you do get a loan, banks might charge you a higher interest rate to offset their risk.

Increased EMIs: You may face higher Equated Monthly Installments (EMIs) if you have a bad score.

Home and Car Loan Issues: Securing home or car loans can become difficult, and you may face additional hurdles.

Delayed Processing: Your loan application could be delayed or put on hold because of your low score.